Take Your E-Commerce Business With You – Wherever You Go

Welcome to the New Age of The Transient Entrepreneur – an era when you can make money, take money, pay money and even borrow money on the move, anywhere in the world. For the techno hobo of no fixed abode, a mobile device and a good connection is all that you need to do business, whether it’s on the beach or at 30,000 feet.

Making Transactions on The Move

With family spread between continents, I’m always hopping between the British Isles and the Andaman region. When Paypal eventually arrived in Thailand, it was a lifeline to be able to send and receive payments online, without paying extortionate bank fees and waiting weeks for money to clear. Before Paypal, I once received a cheque in Thailand from a company in America. When I went to cash the cheque at the bank, I was told by bank staff that it would take 90 days to clear. Three months for a cheque to clear!

Despite the new lease on life and work with the help of Paypal, the payment platform does have limitations when you are on the move between countries, so I’d like to share with you some alternatives to Paypal for businesses and individuals wanting easier access to money management while on the move.

Moving Money from New Locations

Say you are running an online business from the UK with a solid British customer base but you are relocating to Canada, where you want to tap into the Canadian market.

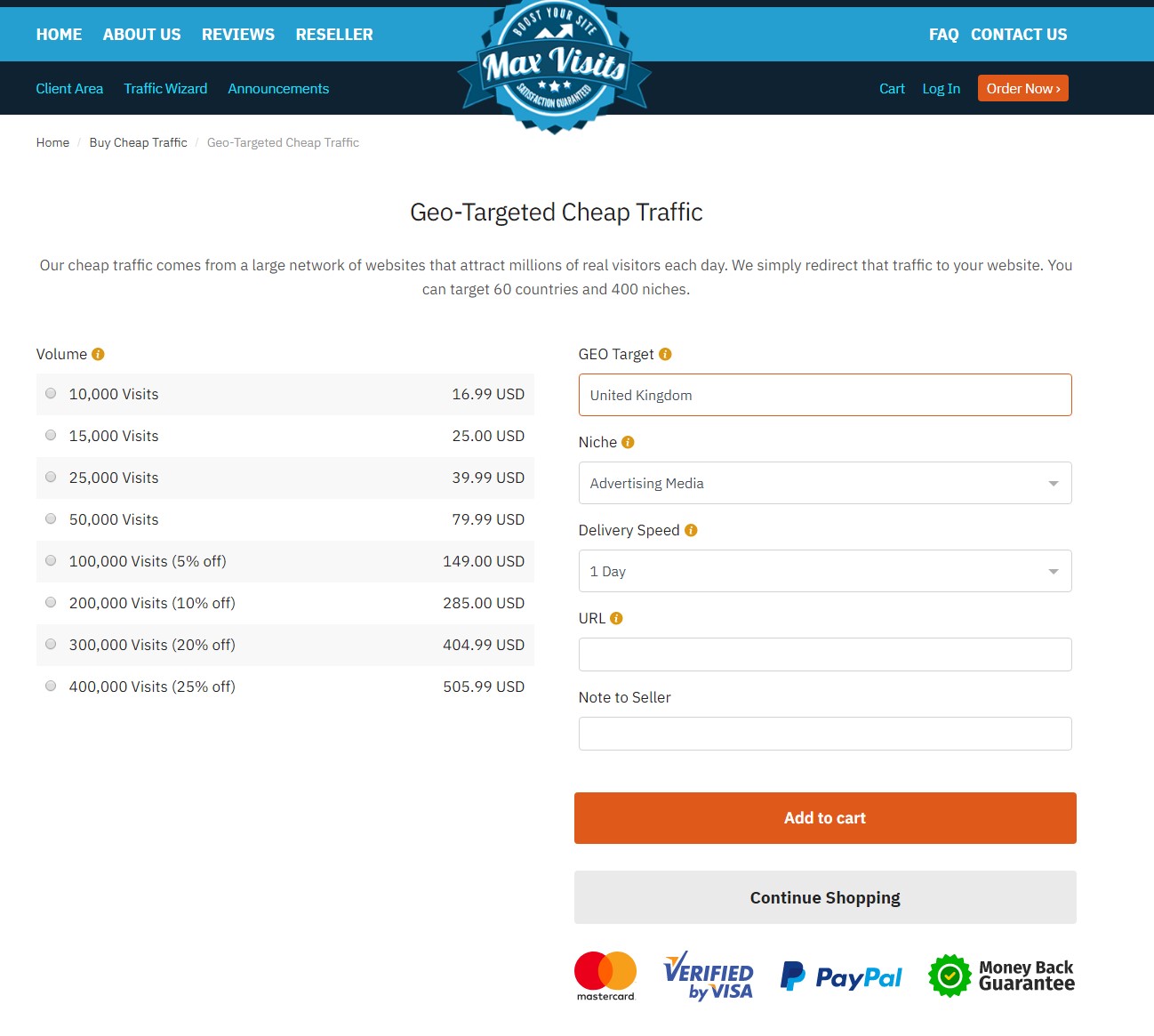

There’s no need to set up a new website just for Canada. A quick and simple way to get exposure for your existing website is to buy geo-targeted traffic and select Canada as a country to target with your highest traffic websites.

Buying targeted traffic is just one of the millions of products and services which an individual or company should be available to purchase without worrying about borders, which is where Paypal can be at a disadvantage to other online payment systems.

PayPal Disadvantages & Limitations

Paying for our web traffic with Paypal or a credit card would usually be plane sailing but if you move to a new country other than the one where you initially set up your PayPal account, moving money around becomes cumbersome..

Paypal doesn’t allow you to use two different addresses. So if you’ve already linked a bank account to Paypal in one country, you can’t link a second bank account in another country, which can be challenging if you wanted to make an online payment by drawing on funds in your new location.

Paypal transactions are also costly, especially when transferring money into a different currency. While Paypal may not appear to charge you for an international transaction, they give you a really bad exchange rate compared to the banks.

Alternatives to Paypal

I’ve compiled a list of other apps and payment gateways to help individuals and businesses send and receive money, and even to take out digital loans. Some of the payment portals are country specific. Others operate in several countries. This list is by no means exhaustive. What’s best for you depends on the kind of transactions you want to make.

2Checkout is used worldwide as a checkout platform for ecommerce available in 15 languages

and for 87 currencies. Fees are charged as a percentage, depending on location.

AliPay is an e-wallet mobile app exclusively for Chinese citizens to make payments at convenience stores such as 7-Eleven in other countries.

Dankort is used by Danish online shoppers to pay for domestic debit purchases and Visa Credit for international and cross-border purchases.

Dwolla is an app available for transferring money only in the US. After users have verified their identity, usually with a photo ID, they can send any amount of money to each other for a flat fee of $0.25 for any transactions over $10.

Ferratum is a digital bank and loaning service based in Denmark and operating in 25 countries. Ferratum rabatkode coupons allow you to take out small interest-free loans of about 200 euro for up to 60 days.

Google Wallet can be used to transfer money from your bank account to any email address. Some online stores accept Google Wallet payments for purchases.

Instagram Checkout offers a way to shop in Instagram stories by allowing customers to showcase their products and take payments from consumers.

Intuit is used by small businesses to accept payments via Quickbooks, adding a fee of about 3% and a small flat rate per transaction with a credit card.

MobilePay is an app available in Denmark and Finland to easily make online payments and for use in physical stores. The app has more than 4 million Danish users.

Payoneer is a peer-to-peer payment system that’s popular with freelancers because you can transfer money with it to anyone anywhere in the world. Transfers can cost $2 or more but it also allows you to make online purchases with a pre-paid Mastercard.

Payza is another peer-to-peer payment method which you can easily link to your credit card and bank account, allowing you to transfer money to another person free of charge for transactions in the same currency. Fees are charged for exchanging currencies.

ProPay enables all types of businesses to accept online payments, even businesses on the road, for which you can use a chip card reader to accept secure payments.

Samsung Pay is an app for Samsung mobile devices which allows you to make online payments as well as contactless payments at checkouts in physical stores, instead of using a credit card. The app stores digital copies of your cards but uses encryption to transmit the details when making purchases. The phone’s facial recognition and fingerprint scanner can be used for extra layers of security.

Samsung Pay launched in Canada in May 2019, and is available in at least 20 other countries, and you can link Samsung Pay to Paypal. So if, for example, you had just moved to Canada and urgently needed to buy a tech gadget with Canadian online store The Source, which only accepts Paypal and major credit cards, you can use a Samsung phone to first go and get a promo code for The Source and then use Samsung Pay to checkout on The Source website.

Skrill is an online payment system exclusively for use in the UK to send money to another person for a small fee. It can be used for making online purchases, including for online casinos, if the vendor accepts the form of payment.

Trustly is a convenient alternative to credit cards available in Europe and the US, which allows consumers to make or receive payment by signing into online banking without leaving the merchant's website or mobile app.

Venmo is a subsidiary of PayPal which gives users a digital wallet connected to their bank account to send money to contacts. The service is popular among millennials. It’s not meant for paying bills but more for transactions between friends.

WePay is a proprietary software platform by JPMorgan used by companies such as GoFundMe for crowdfunding.

A Bright Future for E-Commerce Entrepreneurs

Despite all these alternative payment methods, Paypal is preferred by about 40 percent of online shoppers buying goods and services, which according to Statista, is expected to exceed 2.14 billion people worldwide in 2021.

And with the world still in recovery from the shock of a pandemic scare, doing business in isolation and online is surely set to continue as a trend in the New Age of The Transient Entrepreneur.

Related Posts

Ecommerce marketing relies heavily on understanding consumer behavior and psychology to drive engagement, conversions, and loyalty.

Are you thinking about migrating from one e-commerce platform to another? If yes, then you have come to the right place.

As a business owner, you have to address many challenges in your working life, but one of the most important for the long-term success of your organization is productivity.

Core Web Vitals is a set of performance metrics developed by Google to measure the quality of a website's user experience.

Building an effective website is a vital part of starting and sustaining any small business, and this guide can help you create one tailored specifically to a CBD company's needs.

Consumers in every industry often foster emotional connections with brands via tangible experiences they gain through their five senses.

Comments

comments powered by Disqus